How much do we subsidize cryptocurrency mining’s electricity use? No one knows.

Crypto mines have raised electricity rates for households while receiving big discounts and subsidies.

The explosive growth of proof-of-work crypto mining in the U.S. has increased local air, water, and noise pollution, strained local electric grids, raised electricity rates for residents, and increased climate pollution.

This has led some states that initially welcomed energy-intensive proof-of-work crypto mining to reconsider tax breaks and incentives that encouraged massive facilities in their communities.

But many states, counties, and utility companies continue to hand out significant discounts on electricity to multimillion dollar crypto mining companies. Crypto mines often pay a fraction of other industrial or commercial companies even as they fail to provide promised jobs and crypto mines’ noise, air, and water pollution harm host communities. Earthjustice attorneys analyzed company and utility filings in order to compare average electricity rates to the discounted rates of specific crypto mining companies in five states.

Since Earthjustice and the Sierra Club released a report on the impacts of crypto mining in 2022, the evidence of harm and threats to the grid have only increased. In Texas, one of the first states to encourage large-scale crypto mining, crypto mining raised electricity costs for Texans by $1.8 billion per year, or 4.7%, according to conservative estimates from consulting firm Wood Mackenzie. The state grid operator warned that crypto mines in Texas brought the grid ‘perilously close to failure’ in 2023. Host communities suffer from air and water pollution, electronic waste, and excessive noise pollution. And yet, in many states households continue to subsidize crypto miners’ electricity.

Earthjustice attorneys compared average electricity rates to discounted rates of specific crypto mining companies in Texas, New York, Georgia, Pennsylvania, and Arkansas. Despite extensive research and representing clients before state commissions in Indiana and Kentucky, Earthjustice is not aware of publicly-available information regarding electricity rates for cryptocurrency miners in those states, highlighting the lack of transparency and reporting from the crypto mining industry.

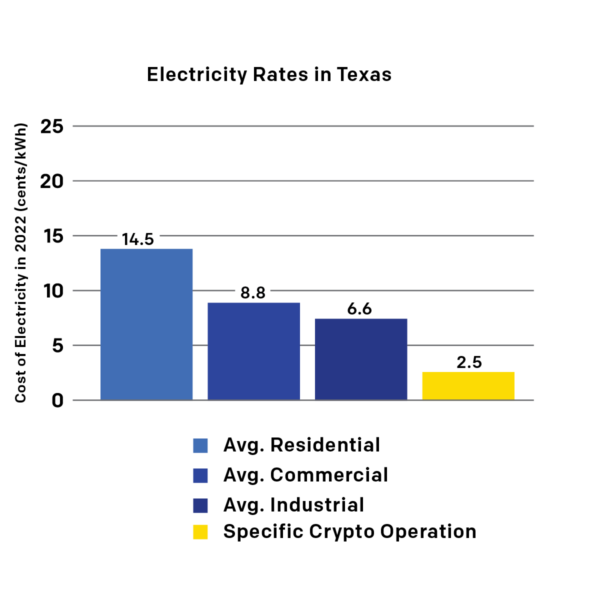

In Texas, in 2023:

- Residential ratepayers paid an average of 14.46 cents/kWh.

- Commercial rate payers paid an average of 8.82 cents/kWh.

- Industrial rate payers paid an average of 6.60 cents/kWh.

Comparatively, crypto miners only paid the following discounted rates:

- Riot has stated in Security and Exchange Commission (SEC) filings that they pay 2.5 – 2.96 cents per kWh for its energy. Riot Bitcoin operates two of the largest Bitcoin mines in the country, one that consumes 450 MWs of electricity and another that currently consumes 400 MWs and is planned to eventually consume 1 GW of electricity.

- Cipher Mining has disclosed that the average cost of electricity was approximately 2.7 c/kWh at their 207 MW facility in Odessa, TX.

- In addition, large crypto miners in Texas also make millions of dollars selling energy back to the grid. Crypto mines take advantage of extreme weather, by selling power it purchased for pennies back to the grid at inflated prices.

Bitcoin mining has already raised electricity costs for Texans. A BloombergNEF report found that energy prices in Texas will soar for consumers if Bitcoin mining continues its rapid expansion. Models show peak energy prices increasing by 30% in one scenario in which the amount of crypto mining peak load roughly triples, and increasing by around 80% in a scenario in which the amount of crypto mining peak load increases around sixfold. The report states, “ERCOT power prices will be a function of new Bitcoin mining facilities.”

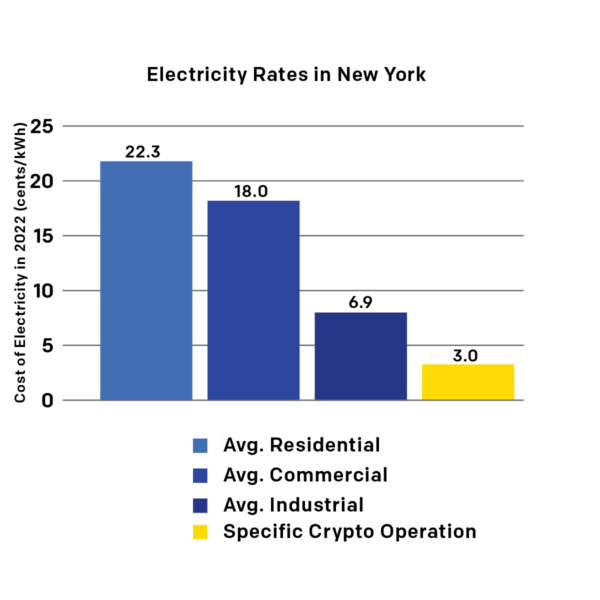

In New York, in 2023:

- Residential ratepayers paid an average of 22.25 cents per kilowatt hours (kW/h) for their electricity.

- Commercial rate payers paid an average of 18.01 cents/kWh.

- Industrial rate payers paid an average of 6.87 cents/kWh.

Let’s compare that to some known cryptocurrency miners in New York State:

- Digihost / World X Generation, a cryptocurrency mining company that bought a whole gas plant for its own personal use in North Tonawanda, New York, pays the equivalent of 3 cents/kWh.

- Terawulf, in Somerset, New York, appears to pay approximately the same, according to recent reporting, which is subsidized by New Yorkers, as most of their energy is provided by the New York Power Authority (NYPA).

- Crypto miners in Plattsburgh, NY paid 2 cents/kWh before the New York Public Service Commission, at the request of the impacted municipality, instituted a new protective rate to protect their community.

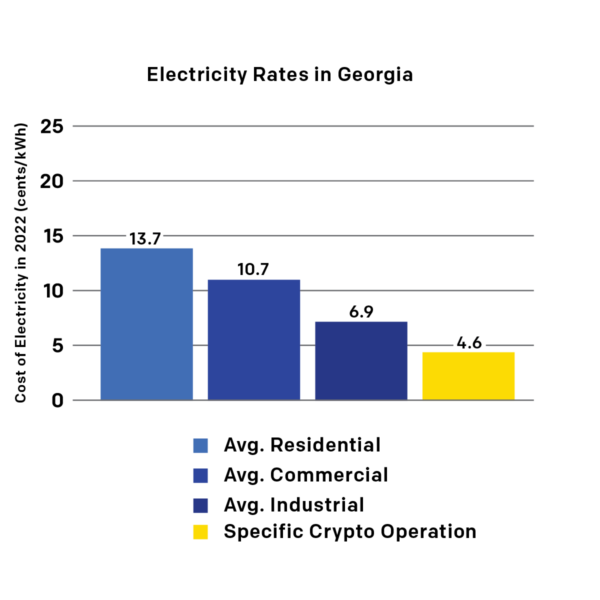

In Georgia, in 2023:

- Residential ratepayers paid an average of 13.69 cents/kWh.

- Commercial rate payers paid an average of 10.70 cents/kWh.

- Industrial rate payers paid an average of 6.88 cents/kWh.

In 2024, a major crypto miner in Georgia paid the following:

- Clean Spark Inc. which consumes several hundred MWs of electricity for its mining operations in Georgia, reported all-in power costs of 4.6 cents/kWh and wholesale electricity costs averaging 3.1 cents/kWh and reaching as low as 1.2 center/kWh at its wholly-owned sites. As of August 2024, CleanSpark owned and operated 12 Bitcoin mining facilities in Georgia.

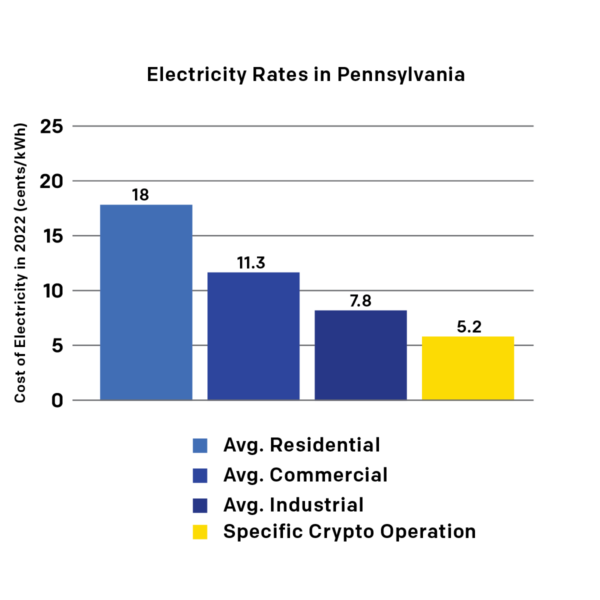

In Pennsylvania in 2023:

- Residential ratepayers paid an average of 18.10 cents/kWh.

- Commercial rate payers paid an average of 11.26 cents/kWh.

- Industrial rate payers paid an average of 7.75 cents/kWh.

- A major crypto mining company in Pennsylvania, Stronghold Digital Mining, which burns toxic waste coal at two sites in Pennsylvania, pays on average 2 to 5.2 cents per kWh.

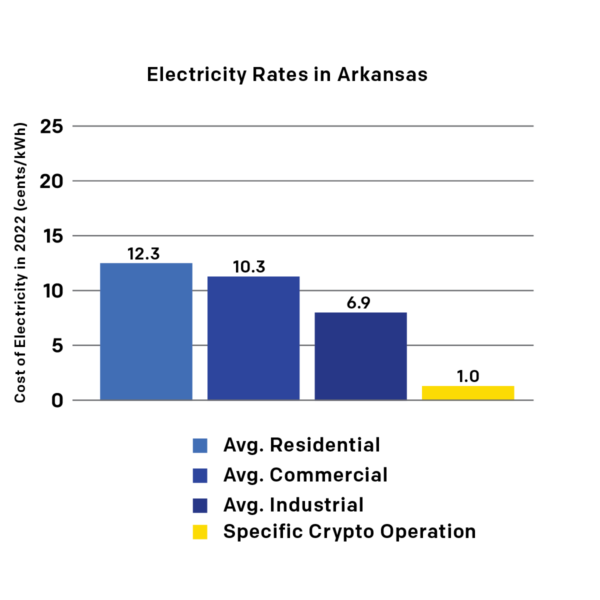

In Arkansas in 2023:

- Residential ratepayers paid an average of 12.25 cents/kWh.

- Commercial rate payers paid an average of 10.34 cents/kWh.

- Industrial rate payers paid an average of 6.87 cents/kWh.

- Crypto miners in the Entergy Arkansas service territory have energy charges of “$0.01035 per kWh in the summer months… and $0.00736 per kWh during the non-summer months,” though this number may exclude other charges associated with electricity service such as a possible customer charge, incremental charge, or any additional rider.

Skyrocketing electricity rates

The immense energy demand of crypto mining — with costly infrastructure investments and discounted electricity rates — often result in higher rates for other utility customers. Electricity rates spiked for households in Washington, New York, Kentucky, Texas, and other states due to crypto mining.

Utilities can spend millions on upgrades to the grid for crypto mines but communities can be left footing the bill when they relocate, or if their actual energy needs are less than they projected. Crypto mining operations, often housed in shipping containers or pods that can be installed (and removed) quickly, present a unique risk of relocation. This led New York, Idaho, Arkansas, Virginia, and Wyoming to establish protections for consumers against the risk of such stranded assets. Protections include upfront payment requirements and requirements that companies pay for certain upgrades to protect existing ratepayers from these costs.

These rate increases threaten to disproportionately impact low-income households, who already spend a higher percentage of their income on electricity than other households, known as energy burden. High energy burdens can force tough choices each month between paying energy bills and buying food, medicine, or other essentials.

And that is just electricity rates.

Lucrative subsidies for crypto mines continue despite harmful impacts

Instead of prioritizing residents, many grid operators and utilities incentivize large electricity users like crypto miners over people. Crypto mining operations are often offered economic development discounts or subsidies and/or access to lucrative demand response payments. They are also offered state and local tax breaks, such as property tax abatements, sales-tax and franchise fee refunds or exemptions, incentives on income taxes and wage assessments, grants, loans, and other inducements.

Kentucky

- Cryptocurrency-specific tax incentives in Kentucky are estimated to cost Kentucky taxpayers at least $9 million a year in lost revenue.

Ohio

- Ohio offers a sales-tax exemption for computer data center equipment, as well as materials used to construct data centers. If the tax break covered all the announced investments over the last two years by just Amazon, Google, and Microsoft, Policy Matters Ohio estimated it would cost almost $1.6 billion in state and local sales-tax revenue.

Pennsylvania

- In 2021, Penn Future estimated that Stronghold Digital Mining Company received $20 million from Pennsylvania tax payers for “alternative” energy credits and other subsidies. Despite harmful sulfur dioxide and nitrogen oxide emissions resulting from burning waste coal and shred tires, Stronghold has disclosed that 60% of its generation costs will be covered by taxpayer subsidies.

Texas

- In August 2023, Texas’s power grid operator handed $31.7 million to Riot to help cut its energy consumption during the intense heatwave. At the same time, Texans were asked to conserve their electricity to protect the grid and saw their power bills soar. In September 2023, Riot received $11 million by selling their previously contracted power, and comparatively earned $9 million in Bitcoin fees.

- In August 2023, Texas’s power grid operator handed $31.7 million to Riot to help cut its energy consumption during the intense heatwave. At the same time, Texans were asked to conserve their electricity to protect the grid and saw their power bills soar. In September 2023, Riot received $11 million by selling their previously contracted power, and comparatively earned $9 million in Bitcoin fees.

Many states that initially welcomed energy-intensive proof-of-work crypto mining are reconsidering tax breaks and incentives that encouraged massive facilities in their communities.

Minimal economic development and job creation

Many crypto mining companies tout the positive economic impacts their operations could have on local communities. In reality, these companies contribute very little to the economic development of these small cities and towns and create few jobs.

A U.S. House of Representatives committee has recognized that, “[w]hile crypto mining facilities do create jobs for communities, the number of jobs is limited due to the highly automated nature of crypto mining and limited need for skilled technicians on-site.”

For example:

- In Rockdale, Texas a crypto mining company promised to build a facility that would create 350 jobs, but in fact only generated 14 jobs.

- Alliance Resource Partners was promised by the Kentucky Public Service Commission over $4 million in discounts, in return for the creation of only five jobs.

- A cryptocurrency mining operation in the Town of Lockport, New York, pledged to create 7 jobs, and in return received $149,000 in property tax breaks and $8,000 in sales tax breaks. In 2023, the company abandoned the premises “with no notice or heads-up.”

- Regarding the Fortistar power plant in North Tonawanda, New York, Niagara County’s economic development commissioner Michael A. Casale stated that such projects are not “as economic development-friendly as [he] would like to see.”

Threats to the grid

The U.S. Energy Information Agency (EIA) reported that crypto mining’s hard-to-predict energy demands threaten to cause brownouts and blackouts during times of peak demand, such as during a cold snap or a heat wave.

Utilities need to be able to reliably predict electricity demand to avoid blackouts. Crypto mines behave unlike any other industrial user, abruptly shutting down when Bitcoin prices fall or power prices spike, or not reducing their electricity use when requested by grid operators when Bitcoin prices are high, for instance.

Harming host communities

Cryptocurrency mining that relies on fossil fuels for energy generation indirectly increases deadly air pollution including nitrogen oxides, which contribute to asthma and are emitted by both coal and gas-fired power plants.

Residents and businesses near crypto mining facilities face constant noise pollution that threaten their health and wellbeing.

Studies have estimated that Bitcoin mining in the United States consumed as much water as 300,000 households in 2021.

Households should not subsidize crypto miners’ electricity. Subsidies for crypto miners led to huge influxes of crypto mines in Texas, Arkansas, Kentucky, and Georgia. But many of those states are now reversing course. In Virginia and Georgia, state legislators introduced legislation to put guardrails on or completely halt tax breaks for data centers and crypto mines. Arkansas passed legislation to protect communities from crypto mining just a year after passing a bill largely written by Bitcoin lobbyists. Several state legislatures, including Georgia, Virginia, and New York are working to eliminate unfair subsidies that are not tied to good jobs, adequate environmental protections, and/or clean energy requirements.

Local regulators and utilities need to consider the impact of crypto mines on our communities, grid, and electricity rates. Earthjustice attorneys will continue to represent local clients in the courts and before utility commissions to protect residential and small business owners.

Earthjustice’s Clean Energy Program uses the power of the law and the strength of partnership to accelerate the transition to 100% clean energy.