Earthjustice goes to court for our planet.

We’re here because the earth needs a good lawyer.

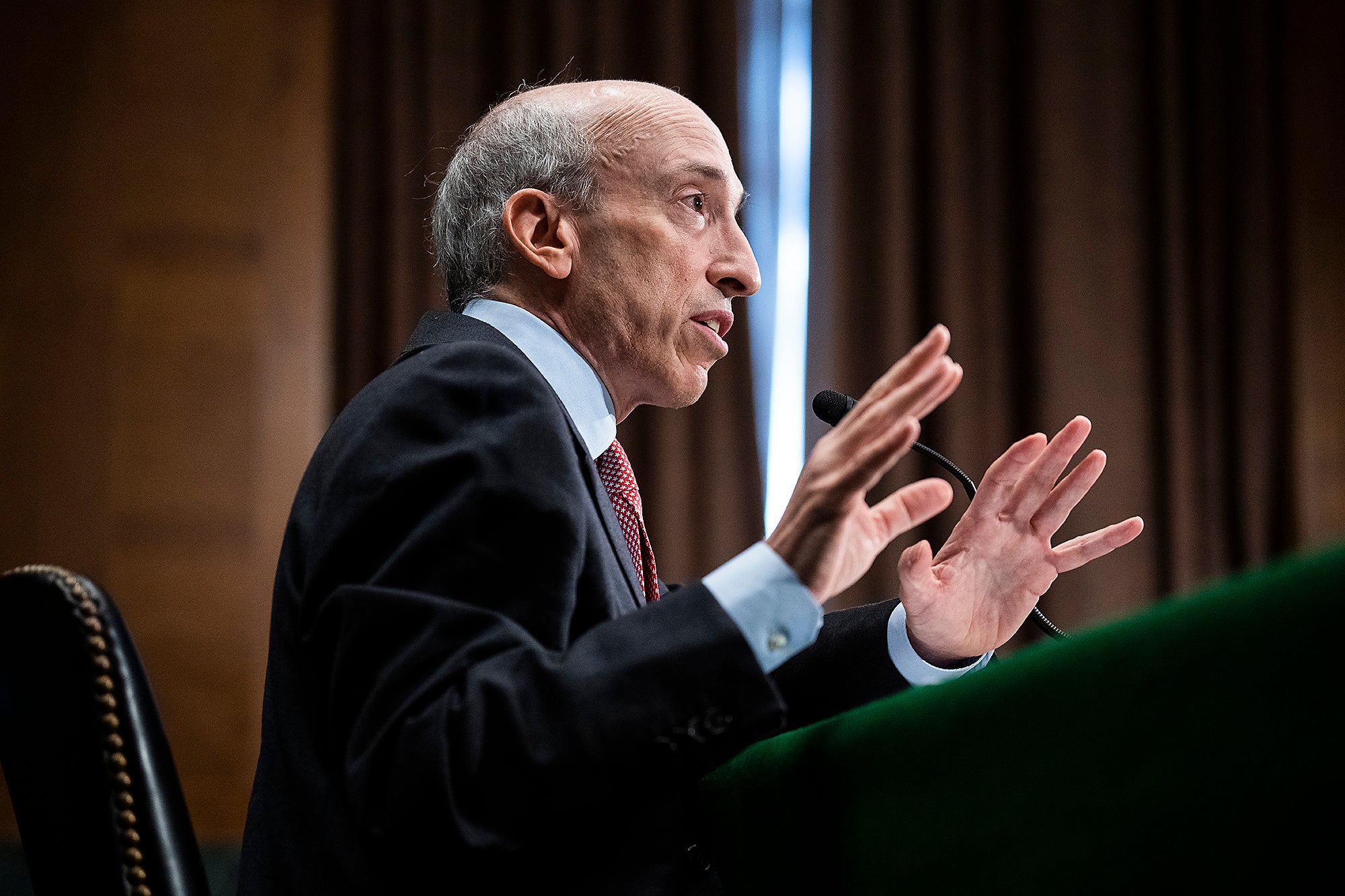

Government Requires Greater Transparency on Climate-Related Financial Risk

This page was published a year ago. Find the latest on Earthjustice’s work.

What Happened: The U.S. Securities and Exchange Commission (SEC) issued its final rule requiring public companies to disclose climate-related risks to their businesses and their plans, if any, to manage or mitigate them. While the rule represents a step forward for investors seeking greater transparency on companies’ handling of climate risks, the rule is disappointingly weaker than an earlier proposed version.

Why It Matters: The climate crisis poses major financial risks to companies and investors, many of whom are already assessing climate-related risks and incorporating them into their corporate and investment strategies. This rule is an important and overdue step to bringing transparency to the market by requiring companies to show their work on how they evaluate climate change impacts to their company and manage the resulting financial risks. However, by significantly weakening the rule, investors are still at risk from misleading and incomplete disclosures.

The climate crisis poses major financial risks to companies and investors.

- The cost of climate change: From extreme drought and wildfires to record storms and flooding, climate disasters already come with an enormous cost.

- Climate change threatens every facet of the U.S. economy, from the housing market to tourism to healthcare to agriculture. No industry is immune to climate-related financial impacts.

- Rippling impacts: Companies also face uncertainty from changes in law, policy, technology, and consumer behavior as we transition to a clean energy economy.

Investors are clamoring for more information on climate risk.

- Companies and investors are already trying to assess climate-related risks and incorporate them into their strategies. But their efforts are hindered by inconsistent and unreliable disclosures on climate-related financial risks.

- Many companies are not fully disclosing climate risks: From oil and gas to agriculture, some of the industries most at risk from climate change do not sufficiently address these risks in their disclosures to investors.

- Climate disclosure protects investors: The SEC’s new rule will bring necessary transparency to the market, protecting investors, and allowing them to make better investment decisions.

- Combating greenwashing: Although these disclosures will improve information for investors on corporate financial risks from climate change, it will leave open opportunities for companies to mislead investors about how well they are prepared for climate risks.

Caving to industry, the SEC’s final rule is weaker than proposed

- Caving to industry: After pressure from industry lobbyists, the SEC eliminated a requirement in its original proposal to disclose indirect emissions from a company’s products and supply chains, known as “Scope 3 emissions”.

- Scope 3 emissions account for the largest share – 75% on average – of most companies’ greenhouse gas emissions, particularly for the most polluting industries.

- This change weakens the rule and enables companies to obscure the full risks they face. Not disclosing Scope 3 emissions could actively mislead investors about the range of risks they face.

- Companies also face weaker requirements to disclose direct greenhouse gas emissions (Scopes 1 and 2) from the final rule, which allows companies to decide for themselves whether their emissions are “material” and thus subject to disclosure.

- What we’re doing: The Sierra Club and Sierra Club Foundation, represented by Earthjustice, are considering challenging the SEC’s arbitrary removal of key provisions from the final rule, while also taking action to defend the SEC’s authority to implement such a rule.